September 6, 2023, 10:18 pm EDT

Fed Fund Rates and Recession

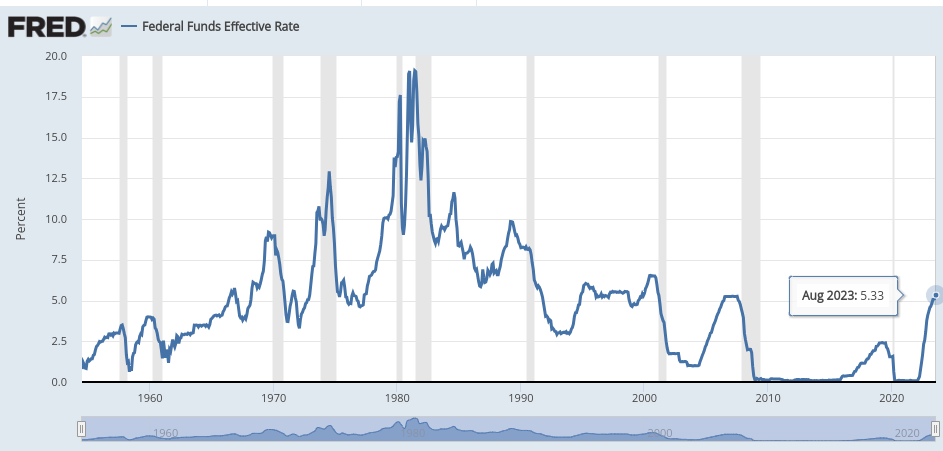

Fed fund rates and recession are closely related. Its correlation can be observed through its chart as shown.

Please note that the gray area means recession or negative GDP for the consecutive quarters. Using the previous recessions like 2007-2008, 2001-2002, 1990-1991, 1981-1982, 1980, 1973-1974, we can clearly see that recession occurred after the rates peaked out.

The logic is simple. The Fed raises the rates to cool down the overheated economy. The number one job for the Fed is to keep inflation out of the picture so that the US economy is sustainable and peaceful. Consequently, the higher rates indeed terminate the red-hot economy. Because the housing markets got cool water. Home buyers have a hard time buying houses when the rates get higher. Consumers feel the pressure of higher debt and its interest like mortgage, car loan, student loan, credit card debts, etc.

Therefore, it is expected that the economy will drop quickly when the rates are going higher. It will control inflation but recession will come as a result.

Currently, we are still in the rising rates environment confirmed by the Fed chairman Jerome Powell and other Fed members. Obviously, we are not there yet to see a 2% target on CPI number.

However, it is important to note that we could be in the late stage of this tightening wave. It is very possible that the peak is near. Possibly, the Fed has one or two hikes to go.

Then, we should see a cooling effect reflected on the housing market and job markets. In our estimation, it could be in the first half of 2024. When the recession threat coming, the second half of 2024 Fed may decide to cut rates.

Therefore, stock market is still very strong but we are in the process of rolling over. So, it should give us a head-up to prepare for the future based on the relationship of the Fed fund rates and recession.