April 8, 2022, 12:01 pm EDT

Leadership Rotation

Do you wonder why DJIA is up +200 points (+0.6%) and Nasdaq is down -90 points (-0.6%) this morning? This is called the leadership rotation.

Leadership rotation indicates the changing behavior of market bias. Previous leaders become laggards and laggards turn into leaders. It does not happen just today. In fact, we already pointed this out in the series articles: Bull-Bear Transition (1,2,3,4). In addition, there were many articles mentioned about the rotation (01/19, 02/25)

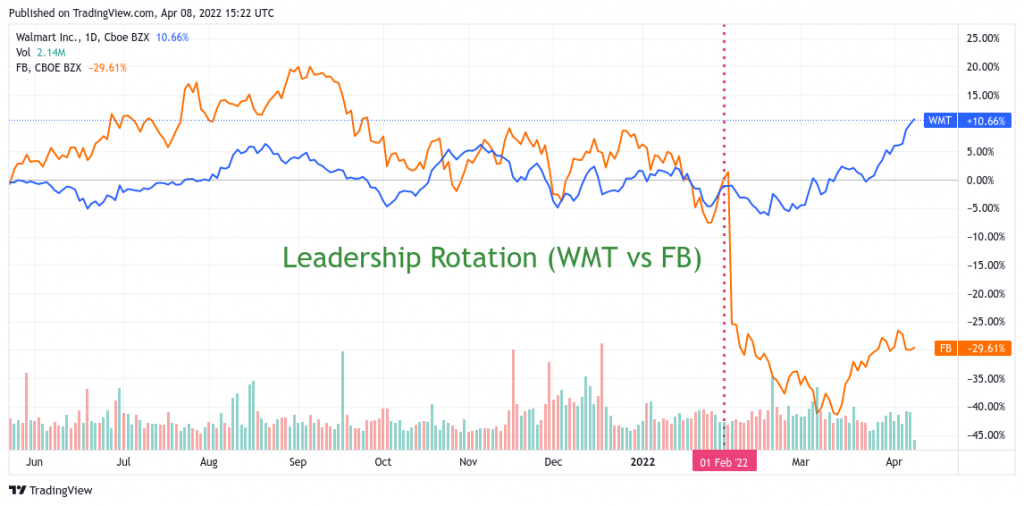

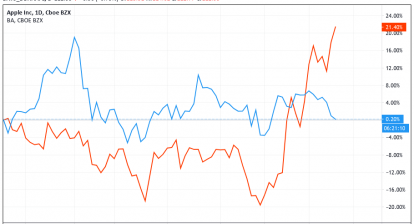

The featured chart shows a comparison of Walmart (WMT) versus Facebook (FB). Facebook used to be a leader in the performance and headline news (Meta Platforms) in the Nasdaq index. Walmart is a retail giant in the Dow Jones index but few people are interested in WMT because of a lack of excitement and performance. FB was the leader and WMT was the laggard until January-February 2022.

The leadership swap does not happen on WMT-FB only. You can replace WMT with United Healthcare (UNH) and FB with AAPL, GOOGL, MSFT, NVDA, TSLA, or other technology names. You will get the same conclusion that consumer staples took over the crown from the technology sector.

It is essential to recognize this change because this change will continue for months to come. The economic cycle has entered a new phase where defensive stocks beat offensive stocks. Similarly, Dow Jones leads Nasdaq.

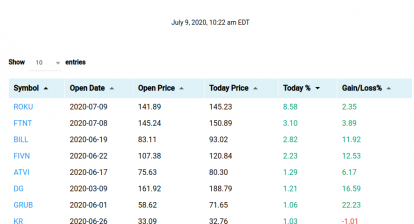

Here is the list of some new leaders: WMT, UNH, ADM, COST, KR, SFM, GO, ANTM, BG, ABBV

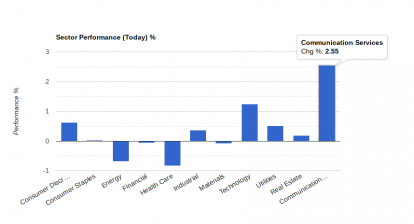

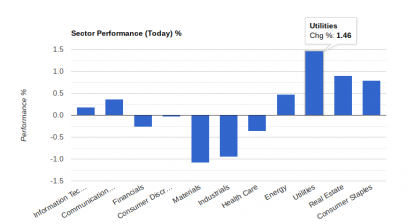

We believe the new leaders would keep emerging in both defensive sectors (healthcare, consumer staples, utility, REIT) and core sectors (financial, industrial, energy). The past leading sectors (technology, communication, cyclical) will fade as laggards.

The rising rates, inflation, balance sheer reduction, wars, and tighter supplies are all working together to make this rotation. Thus, it is not a few simple factors to make this switch. It is the gigantic gear switching from the economic cycle.